Ten days ago, Sen. Susan Collins voted in favor of the GOP tax scam to kick 13 million people off of their health insurance, raise premiums double digits for millions more and trigger a $25 billion cut to Medicare, all to pay for a tax cut for the wealthiest and big corporations. She argued it wasn’t a bad bill and claimed she had promises from GOP leaders to move alternative bills forward. In the days since, it’s been made abundantly clear neither of these things is true.

How is her vote playing out in Maine?

Maine Beacon: “Hundreds brave winter storm to tell Sen. Collins: ‘You are wrong’ on tax bill.” “Despite freezing temperatures and the season’s first significant snowfall, an estimated 250 people from across New England turned out Saturday to demand that Senator Susan Collins finally listen to the will of the voters and reject the Republican tax overhaul. The line of protesters marched across Memorial Bridge, which connects Portsmouth, New Hampshire to Kittery, Maine, behind a banner which read: ‘Sen. Susan Collins, You Are Wrong.’”

Kennebec Journal & Morning Sentinel: “Our View: Collins should drop support for tax bill.” “When she gets another chance, Collins should vote against the bill that’s now being negotiated in a House-Senate conference committee and stop this process before it’s too late. There is no shortage of reasons for her to withdraw her support.”

Alex Luck, Bangor Daily News: “Susan Collins support of the Senate tax bill is a betrayal of Maine’s veterans.” “As a veteran, it pains me to see just how badly the Republican tax bill that the Senate just passed will hurt my fellow veterans. What’s worse, I’m heartbroken to see Collins vote for this bill that punishes veterans and threatens millions of families’ health and well-being by dismantling a key part of the Affordable Care Act. I’d expect such cruelty from the far-right fringe. I’m shocked to see Collins go along with it.”

How about nationally?

Washington Post Editorial Board: “Susan Collins is getting it wrong.” “If the reinsurance plan were larger and perpetual, Ms. Collins would have a better argument. If Republicans had spent months examining the effectiveness of the mandate, waited for a new assessment from the Congressional Budget Office and drafted a stand-alone bill that included replacement policies, they would have more credibility in making such a large and risky change in the Obamacare system. But this is not what happened.”

New York Times: “Susan Collins and the Duping of the Centrists.” “A couple of weeks ago, Collins made a classic Collins deal. It tried to split the difference between Democratic and Republican positions. But it sure looks like a bum deal now… Her strategic error is the one that holds lessons for other would-be centrists. Namely, she defined the political center in relative terms rather than substantive terms. Republican leaders — not just Trump, but McConnell and Ryan too — have moved sharply to the right. They are rushing through a bill without the normal procedures. They are making verifiably false claims about it. And they have decided that taking health insurance away from Americans is a core Republican principle. Collins made the mistake of chasing after an impossible deal. She wanted to position herself between the two political parties, and she wanted to protect Medicare and Medicaid. When it proved impossible to do both, she claimed otherwise — and put a higher priority on politics than policy. In Trump’s Washington, other centrist Republicans are going to face a version of her dilemma, again and again. They are going to have decide which matters more to them: being a loyal Republican or being an actual centrist.”

What about her assertions that these other bills will mitigate the damage of the tax scam?

National Public Radio: “Doubts Rise About Sen. Collins’ Strategy To Shore Up Insurance Market.” “Sen. Susan Collins, the Maine Republican whose vote was pivotal in pushing the GOP tax bill forward last week, thought she had a deal to bolster health care protections in exchange for her support. But it’s now unclear whether her strategy to shore up part of the Affordable Care Act will prevail or that it would produce the results she anticipates… Would Collins’ changes offset the elimination of the mandate? Some analysts question whether the bill restoring the federal cost-sharing subsidy payments could actually do more harm than good. ‘It’s a mess,’ says insurance industry consultant Robert Laszewski.”

Bloomberg: “These Senators Could Doom Tax Cuts (But Won’t).” “Collins says she has commitments from party leaders that the Medicare cuts never would be enacted, along with support for separate legislation that would address problems like insurance-premium increases caused by the mandate repeal… There are several problems with these reassurances. Nobody can promise now that a future Congress won’t cut Medicare. Nor is there any guarantee that the House of Representatives would go along with the separate measures to help the insurance market.”

Washington Post: “Susan Collins is enabling a bad tax bill.” “Collins’s support for the two measures, she would argue, mitigates some of the damage from repeal of the individual mandate. However, ‘some’ is not ‘all,’ and she has not attempted any fix beyond 2020. Andy Slavitt, former acting head of the Centers for Medicare and Medicaid Services, tells me, ‘Even the study Senator Collins cited shows that the policies she’s proposing would undo only a small fraction of the coverage losses from mandate repeal and would have only temporary benefits. On the small chance that Paul Ryan decides to keep in Senator Collins’s amendments, this deal would not accomplish what she had hoped it would.’ And that brings us back to the original issue: Why allow Senate Republicans to wreck the individual exchanges under the guise of tax reform?”

Are the promises not to cut Medicare at least holding up?

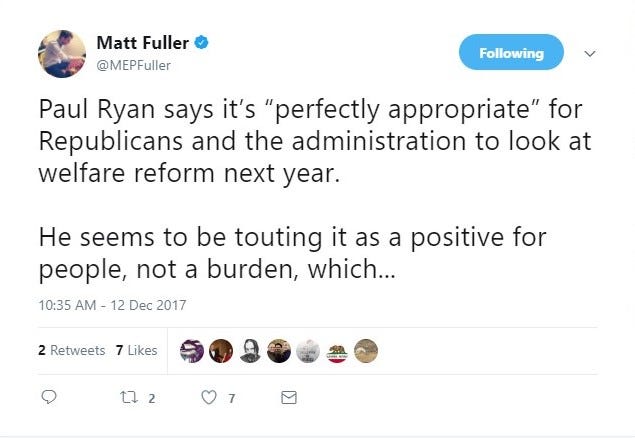

Paul Ryan: “Perfectly Appropriate” to Look at Cuts.

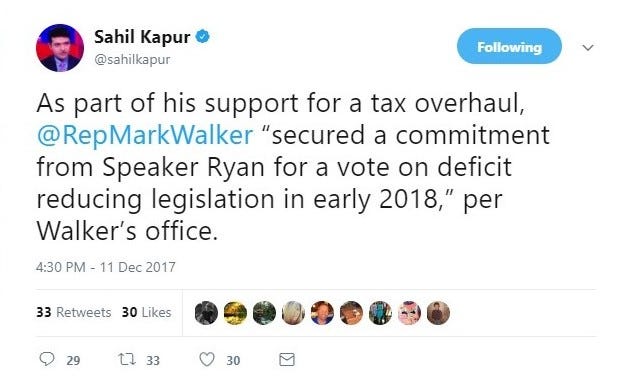

Mark Walker: “Secured a Commitment” to Vote on These Cuts.

Senator Collins, it’s never been more clear: Mainers are furious over your vote, health care advocates are adamant about the problems it will bring, and the GOP’s lies are getting harder to cover by the hour. Do the right thing — oppose the GOP tax scam.