NATIONALLY, ASSOCIATION HEALTH PLANS HAVE A HISTORY OF FRAUD AND UNPAID CLAIMS

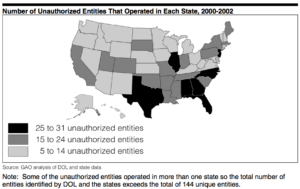

Between 2000 and 2002, AHPs Left 200,000 Policyholders with $252 Million In Unpaid Medical Bills. “There have been several documented cycles of large-scale scams. According to the GAO, between 1988 and 1991, multiple employer entities left 400,000 people with medical bills exceeding $123 million. The most recent cycle was between 2000 and 2002, as 144 entities left 200,000 policyholders with $252 million in unpaid medical bills.” [United Hospital Fund, 3/6/18]

[GAO, February 2004]

Former Insurance Fraud Investigator: “Fraudulent Association Health Plans Have Left Hundreds Of Thousands Of People With Unpaid Claims.” “Marc I. Machiz, who investigated insurance fraud as a Labor Department lawyer for more than 20 years, said the executive order was ‘summoning back demons from the deep.’ ‘Fraudulent association health plans have left hundreds of thousands of people with unpaid claims,’ he said. ‘They operate in a regulatory never-never land between the Department of Labor and state insurance regulators.’” [New York Times, 10/21/17]

Dr. James Madara, CEO of the American Medical Association: Association Health Plans Have Potential To Threaten Health And Financial Stability. “Fraudsters prey upon areas of regulatory ambiguity and may challenge such authority in courts to further delay enforcement, which allows more time to increase unpaid medical claims…Without proper oversight to account for insolvency and fraud, AHPs have the potential to … (threaten) patients’ health and financial security and the financial stability of physician practices and other providers.” [Modern Healthcare, 3/7/18]

INSURANCE COMMISSIONERS AGREE THAT ASSOCIATION HEALTH PLANS ARE BAD FOR CONSUMERS

National Association of Insurance Commissioners: Association Health Plans Are Bad For Consumers. “AHPs would fragment and destabilize the small group market, resulting in higher premiums for many small businesses…AHPs would be exempt from state solvency requirements, patient protections, and oversight exposing consumers to significant harm.” [NAIC]

Pennsylvania Insurance Commissioner Concerned About Potential For Consumer Harm Under AHPs. “The proposed rule would also loosen existing commonality of interest requirements to allow associations to form simply based on membership in the same trade, industry or profession..If a self funded MEWA were permitted to form in a neighboring state and to sell to Pennsylvania association members under the metro area provision, Pennsylvania regulators would not have the ability to assist a Pennsylvania resident if problems arise with the other state’s association, including claim denials, or, worse yet, in the event of insolvency or fraud.” [PA Insurance Commissioner Jessica Altman, 3/6/18]

California Insurance Commissioner: “The Proposed Rule Is A Perfect Storm Of Bad Ideas.” “The AHPs proposed by this rule will harm consumers by degrading the individual and small group health insurance markets through adverse selection, and will impinge upon states’ rights while opening the door to fraud, insolvency and abuse…The proposed rule in no way limits the ability of states to regulate MEWAs, insurers offering coverage through MEWAs, and insurance producers marketing that coverage to employers. However, the checkered history of MEWAs instructs that unscrupulous actors will try and exploit any change which can be mischaracterized as constituting ERISA preemption.” [CA Insurance Commissioner Dave Jones, 3/6/18]

PATIENT GROUPS, HOSPITALS, AND KEY HEALTH STAKEHOLDERS CONDEMN AHPs

American Cancer Society Cancer Action Network: “We Are Also Concerned About The Proliferation Of AHPs Because Of Their History Of Fraud And Financial Instability.” “For a long time, these products were not traditionally subject to the same state insurance solvency and licensing requirements that allowed regulators to maintain necessary oversight.5 If an AHP lacked the financial resources to pay claims, then enrollees were left with no coverage and high out-of-pocket costs. Even in cases of well-meaning AHP sponsors, insolvencies led to millions of dollars in unpaid claims.” [ACS-CAN, 3/6/18]

American Hospital Association: AHPs “Ultimately Decreas[e] Access To Affordable Coverage.” “We are concerned that this rule fails to protect against discriminatory insurance practices and could contribute to instability in the individual and small group market, ultimately decreasing access to affordable coverage.” [American Hospital Association, 3/6/18]

Coalition Of 118 Patient And Community Organizations Urges Department Of Labor To Reconsider AHPs. “We believe that the proposed changes would negatively impact access to quality, affordable care for consumers, disrupt the individual and small business marketplace, and further strain the limited resources of state regulators…The intent of the President’s executive order was to increase consumer choice while curbing costs, however we believe that AHPs as proposed would invariably weaken the individual and small group markets leading to higher healthcare costs for all; higher premiums for those who stay in the marketplace, and high out of-pocket costs for those who are covered by AHPs for unexpected medical needs.” [Coalition Of 118 Patient And Community Organizations, 3/6/18]

AHPs ARE HOTSPOTS FOR FRAUD IN STATES:

Florida

A Labor Department Lawsuit Revealed An AHP Had Concealed Financial Problems And Left $3.6 Million In Unpaid Claims. “The Labor Department filed suit last year against a Florida woman and her company to recover $1.2 million that it said had been improperly diverted from a health plan serving dozens of employers. The defendants concealed the plan’s financial problems from plan participants and left more than $3.6 million in unpaid claims, the department said in court papers.” [New York Times, 10/21/17]

In Florida, A Man Pleaded Guilty To Embezzling $700,000 In Premiums From the AHP He Ran in 2004 To Help Build A Home For Himself And Was Sentenced To 57 Months In Prison. “A Florida man was sentenced to 57 months in prison after he pleaded guilty to embezzling about $700,000 in premiums from a health plan that he had marketed to small businesses. The Labor Department and the Justice Department said he had used some of the plan premiums to build a home for himself.” [New York Times, 10/21/17]

In 2004, A Florida Woman Was Left With $500,000 In Unpaid Medical Bills While She Was Covered By Association Health Plan. “Joan Piantadosi, a small business owner bought health insurance from Employers Mutual LLC through an association for herself, her family, and her employees. She was left with more than $500,000 in unpaid medical bills for her husband’s treatment during the time she was covered by Employers Mutual LLC. On top of that, her husband needed a liver transplant to live. In her own words, “[W]e were informed that since we lacked insurance coverage, we would have to pay a deposit of $150,000 before my husband could enter the hospital’s Liver Transplant Inpatient program. We simply did not have $150,000 to cover the deposit. Consequently, my husband was removed from the recipient list…We feared, among other things, that my husband might die while we were attempting to deal with the predicament of being uninsured despite having paid premiums to what appeared to be a legitimate health insurer.” [United Hospital Fund, 3/6/18]

Louisiana

In Louisiana, Two People Pleaded Guilty To Using Money From The AHP For Spa Treatments, Diamond Cuff Links, Foreign Travel And Other Personal Expenses. “And in Louisiana, two people pleaded guilty to conspiracy charges after the government found that they had taken money from the medical benefit fund of a trade association and used it to pay for spa treatments, diamond cuff links, evening gowns, foreign travel and other personal expenses.” [New York Times, 10/21/17]

Texas

In Texas, Patients Thought They Were Insured Until Told Otherwise In A Moment Of Crisis. “Robert Loiseau, who represented fraud victims in Texas, recalled their shock when they tried to receive care. ‘People bought insurance coverage because it was cheap and seemed to provide them with coverage they needed,’ he said. ‘It had a veneer of legitimacy. But when they went to the doctor, they found out all of a sudden that their insurance company, their perceived insurance company, was in receivership and that they had no coverage.’” [New York Times, 10/21/17]

Between 2001 And 2003, Texas Shut Down 129 Unauthorized Insurance Operations. “In the last two years, the Texas Insurance Department shut down 129 unauthorized insurance companies, affiliates, operators, and their agents whose illegal actions affected more than 20,000 Texans.” [The Commonwealth Fund, August 2003]

New Jersey

In 2002, An AHP Became Insolvent With $15 Million In Outstanding Claims. “For example, when a long-standing AHP in New Jersey that covered 20,000 people became insolvent in 2002, it had $15 million in outstanding medical bills. This left participating businesses and their employees’ claims unpaid even though employers paid premiums to the AHP.” [Commonwealth Fund, 10/10/17]

A Health Plan For New Jersey Small Businesses Collapsed With $7 Million In Unpaid Claims. “In another case, a federal appeals court found that a health plan for small businesses in New Jersey was ‘aggressively marketed but inadequately funded.’ The plan collapsed with more than $7 million in unpaid claims.” [New York Times, 10/21/17]

South Carolina

In South Carolina, A Man Pleaded Guilty To Diverting Nearly $1 Million From An AHP For Churches And Small Businesses, Leaving $1.7 Million In Unpaid Claims. “A South Carolina man pleaded guilty after the government found that he had diverted more than $970,000 in insurance premiums from a health plan for churches and small businesses. ‘His embezzlement and the plan’s consequent failure left behind approximately $1.7 million in unpaid medical claims,’ the Labor Department said.” [New York Times, 10/21/17]

Across State Lines: North Carolina, Maryland, And Beyond

One AHP Scheme Shows How AHPs Can Move From State To State. Families USA chronicled an AHP scheme involving the American Trade Association, Smart Data Solutions, and Serve America Assurance. They found:

- “Even after one state identifies a problem, the company may continue to operate for years in other states. North Carolina issued a cease and desist order to stop many of the players in this case from selling insurance in 2008.”

- “But by June 2010, when Maryland issued a cease and desist order, the plans sold by these players had been identified in at least 23 states. Estimates of total premiums paid to these companies for unauthorized, unlicensed plans range from $14 million to $100 million.”

- “This particular scheme operated through associations that went by many different names. (At least one of the players in this case was involved in a previous case concerned with fraudulent insurance sold through an association of employers in 2001-2002.)”

- “Consumers are often ill-protected when they buy coverage through an association, and the web of relationships among salespeople, associations, administrators, and actual insurers can be difficult for regulators to unravel and oversee. Consumers may be encouraged to join fake associations to buy health insurance so they have an illusion of coverage—and the insurers collect membership dues and premiums while illegally avoiding state oversight).” [Families USA, October 2010]

GAO Report In 1992 Showed Similar AHPs Left At Least 398,000 Participants With More Than $123 Million In Unpaid Claims And More Than 600 Plans In Almost Every State Failed To Comply With State Laws. “Back in 1992, the Government Accountability Office issued a scathing report on these multiple employer welfare arrangements (known as MEWAs; they’re pronounced “mee-wahs”) in which small businesses could pool funds to get the lower-cost insurance typically available only to large employers. These MEWAs, said the government, left at least 398,000 participants and their beneficiaries with more than $123 million in unpaid claims between January 1988 and June 1991. Furthermore, states reported massive and widespread problems with MEWAs. More than 600 plans in nearly every U.S. state failed to comply with insurance laws. Thirty-three states said enrollees were sometimes left without health coverage when MEWAs disbanded…’MEWAs have proven to be a source of regulatory confusion, enforcement problems and, in some instances, fraud,’ the GAO wrote at the time.” [Washington Post, 10/12/17]