If Congress Fails to Stop Republican Price Hikes, 20 Million Will See A Steep Increase In Health Care Costs and 5 Million Will Lose Coverage

The Inflation Reduction Act’s tax credits that lower health care costs for millions of Americans are set to expire at the end of 2025. Republicans are fighting to let these tax credits expire, which will make health care more expensive for the middle class. Hardworking families are counting on lawmakers to act, but Republicans only want to raise costs on middle-class families while handing out tax breaks to the rich. If Republicans get their way, premiums will skyrocket for over 20 million Americans, and 5 million Americans will become uninsured.

This is just the latest MAGA attempt to sabotage the Affordable Care Act (ACA). More than 21 million Americans enrolled in coverage in 2024 – an all-time high – which means that more people than ever rely on the ACA to get the health care they need. This includes small business owners, people living in high-cost rural areas, farmers, people with pre-existing conditions, older adults, and more. Congress must act now to stop Republicans from hiking health care costs and forcing more families to choose between seeing a doctor or keeping a roof over their heads.

New Study By Center for Budget and Policy Priorities Shows Health Care Costs Will Spike For Middle Class Families and Older Adults In Every State If Enhanced Tax Credits Expire.

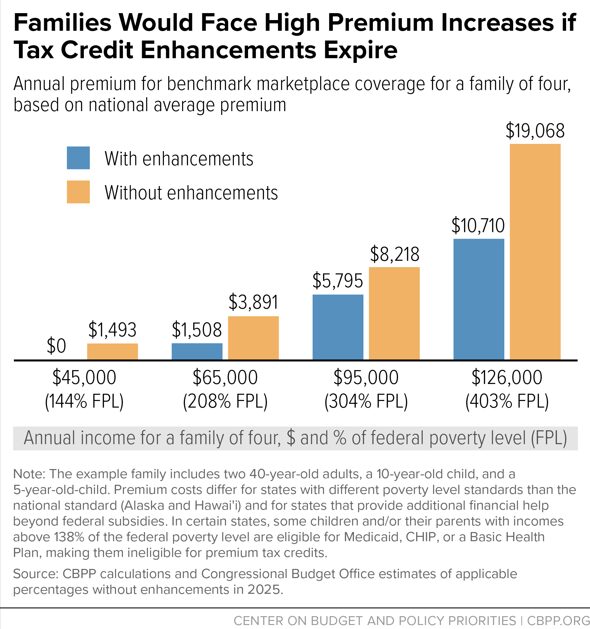

- Families Will See Their Annual Premiums Rise By As Much As $32,350 In Some States. In states such as Alaska, West Virginia and Wyoming, annual health care costs will increase by $26,700, $24,549, and $22,707 for a family of four making $126,000. Nationwide, a typical family of four making $126,000 a year will see their monthly marketplace premium increase from $893 to $1,589 – an annual increase of nearly $8,400.

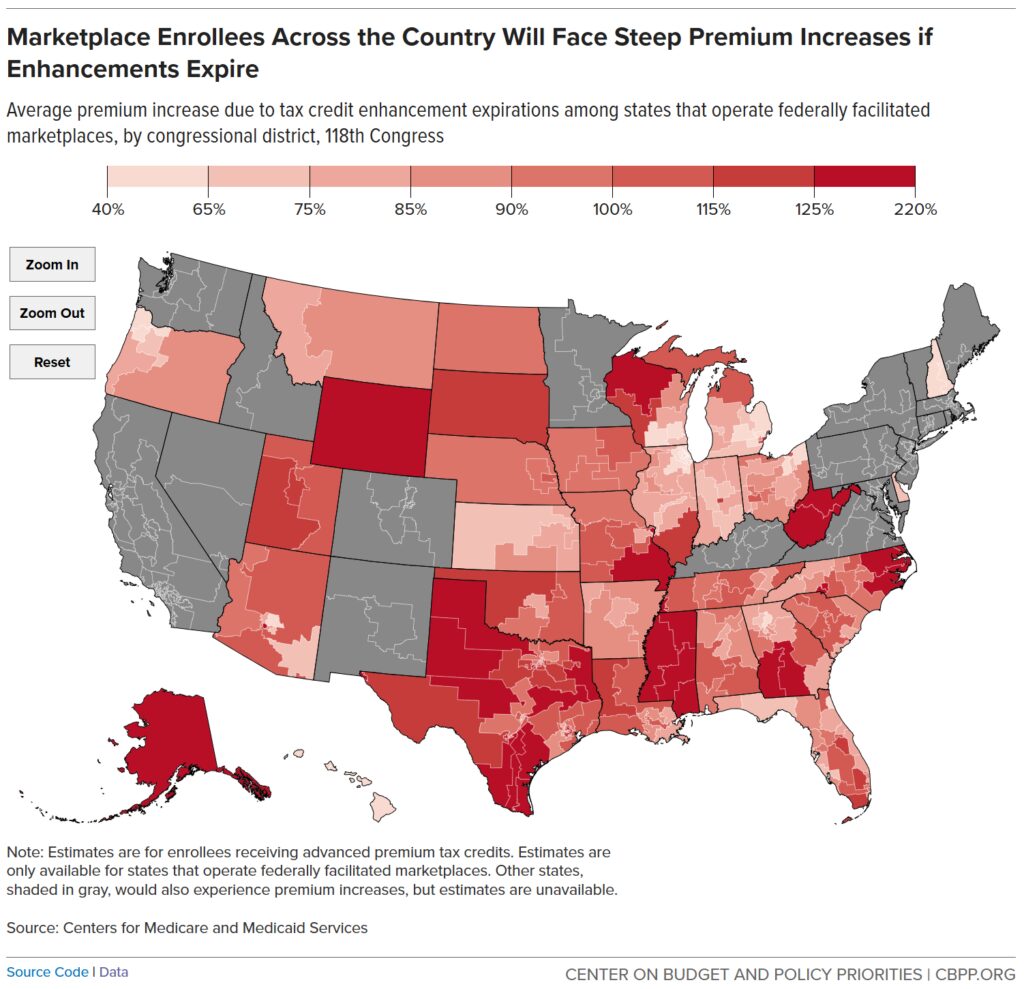

- Premiums Will Nearly Double On Average Within Congressional Districts. The average annual premium will increase by a median of $684 in Congressional districts nationwide. Premium increases will range from 41 to 218 percent in each district, with a median increase of 91 percent, meaning premiums will nearly double on average within Congressional districts.

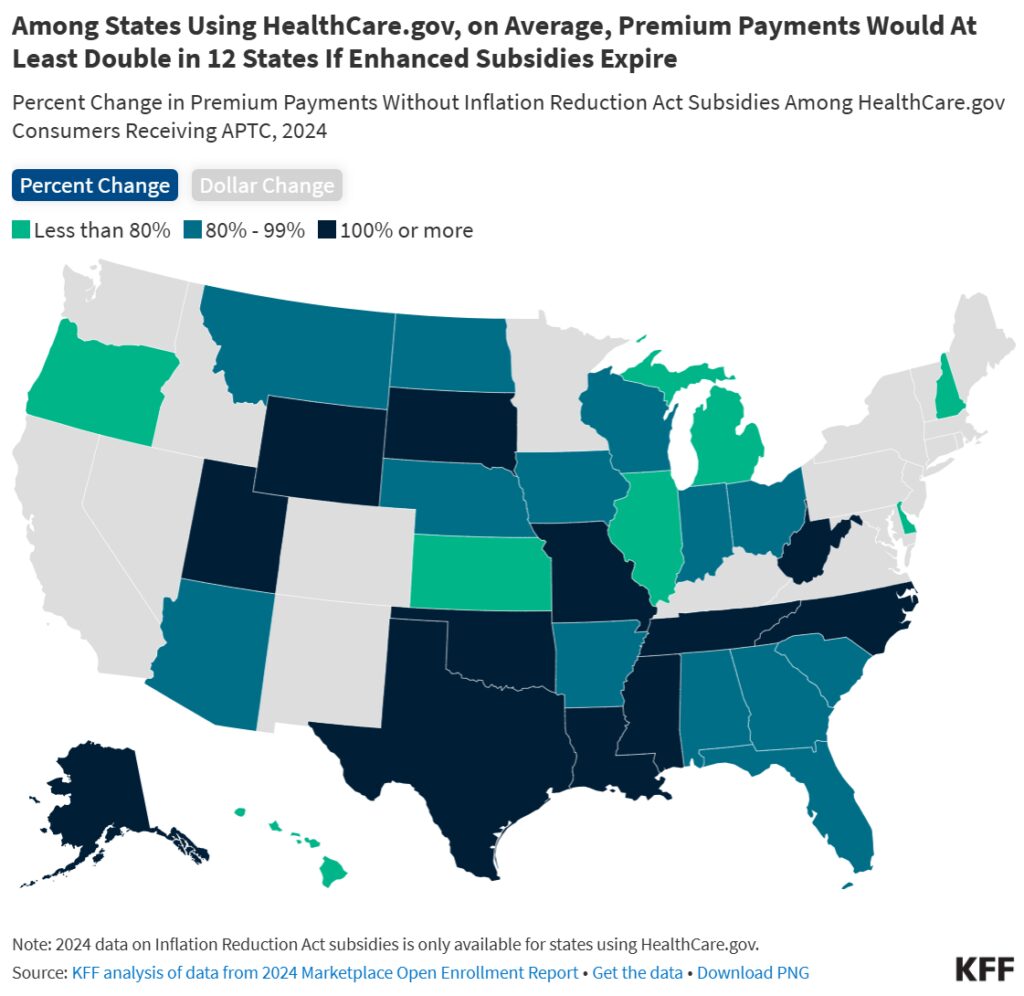

KFF Study Shows Premiums Would Increase By 49 To 195 Percent In States Using Healthcare.gov

- Premiums Would At Least Double In 12 States, all Represented by Republican Senators. Premiums currently average about $672 a year for residents who receive tax credits in states that use healthcare.gov. Without the enhanced premium tax credits, the average annual premium payment would rise by 93 percent ($624) to $1,296 a year.

- Congress Will Need To Take Action By Spring 2025 To Avert A Spike In Premiums. Since insurance companies are required to finalize premiums for 2026 by August 2025, if Congress hasn’t taken action this Spring, insurance companies will count on an expiration of the enhanced premium tax credits. Insurers will expect the gains in Marketplace enrollment will reverse and the health status of remaining enrollees to be sicker, on average, than it is with enhanced subsidies. If insurers expect to lose their healthier enrollees, they will raise premiums heading into 2026 and consumers will see higher costs as early as 2025.

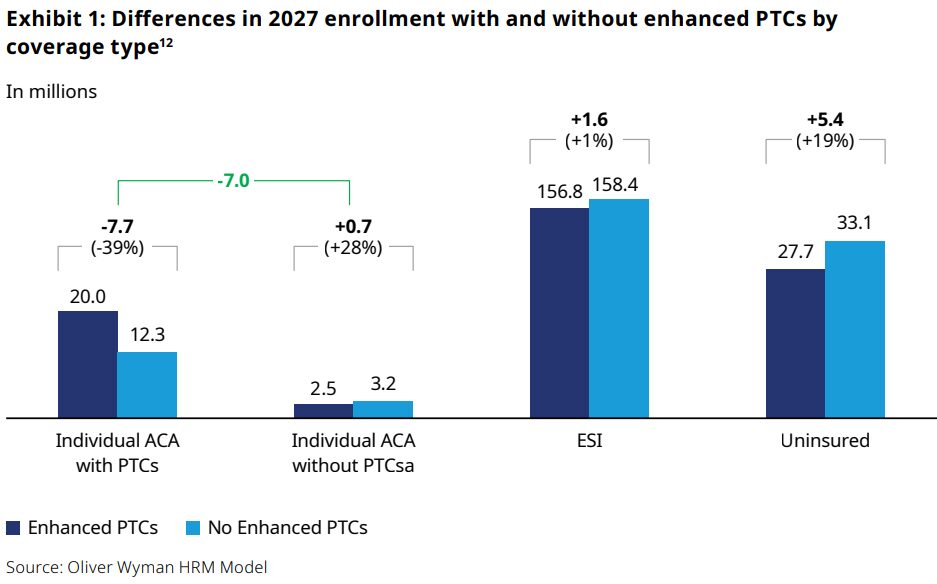

An Actuarial Firm Estimated A Total Of 5.4 Million Americans Will Lose Health Care If Congress Fails To Extend the Enhanced Premium Tax Credits.

- Young Adults, People of Color, and People With Chronic Disease Will Be Disproportionately Impacted. 47 percent of younger adults (ages 18-34) are projected to lose their marketplace coverage. 52 percent of Black enrollees and 49 percent of Hispanic enrollees are expected to do the same. Roughly 1.7 million enrollees with at least one of six chronic conditions such as cancer, diabetes, and cardiovascular disease are expected to lose their health care entirely.

- Premiums Will Increase For All Marketplace Enrollees, Even Those Who Don’t Receive Tax Credits. Healthier enrollees are expected to leave marketplace enrollment at a higher rate than those with significant health care needs, throwing the risk pool out of balance, and driving up premiums across the board in the Affordable Care Act Marketplace.

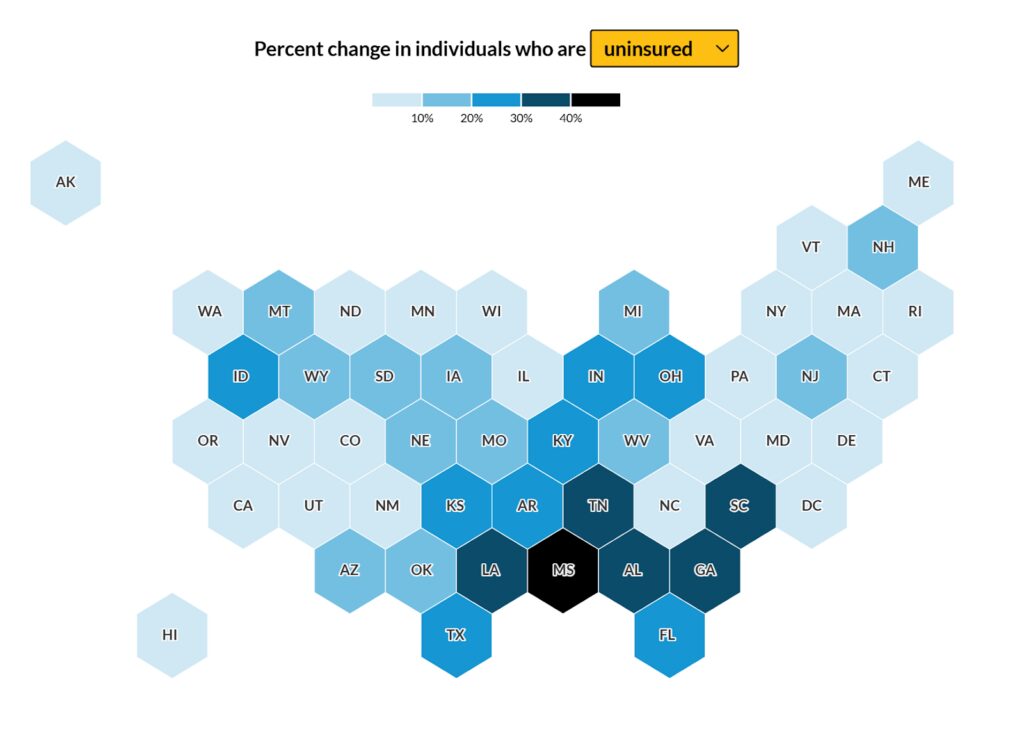

Urban Institute Predicts States Will See A Huge Increase In Uninsured.

- Expiration Of The Enhanced Premium Tax Credits Will Lead To An 16 Percent Increase In Uninsurance Nationwide. Black and Latino enrollees will make up a disproportionate share of those who lose coverage. 1.8 million Black and Latino Americans will become uninsured.

- States That Refuse To Expand Medicaid Will Suffer The Greatest Losses of Coverage. Without renewal of the enhanced premium tax credits, nearly 2.5 million people will lose health care across states without Medicaid expansion – resulting in a 27 percent increase in uninsurance across those states. States such as Mississippi and Alabama will see a 43 percent and 34 percent increase in uninsured respectively.

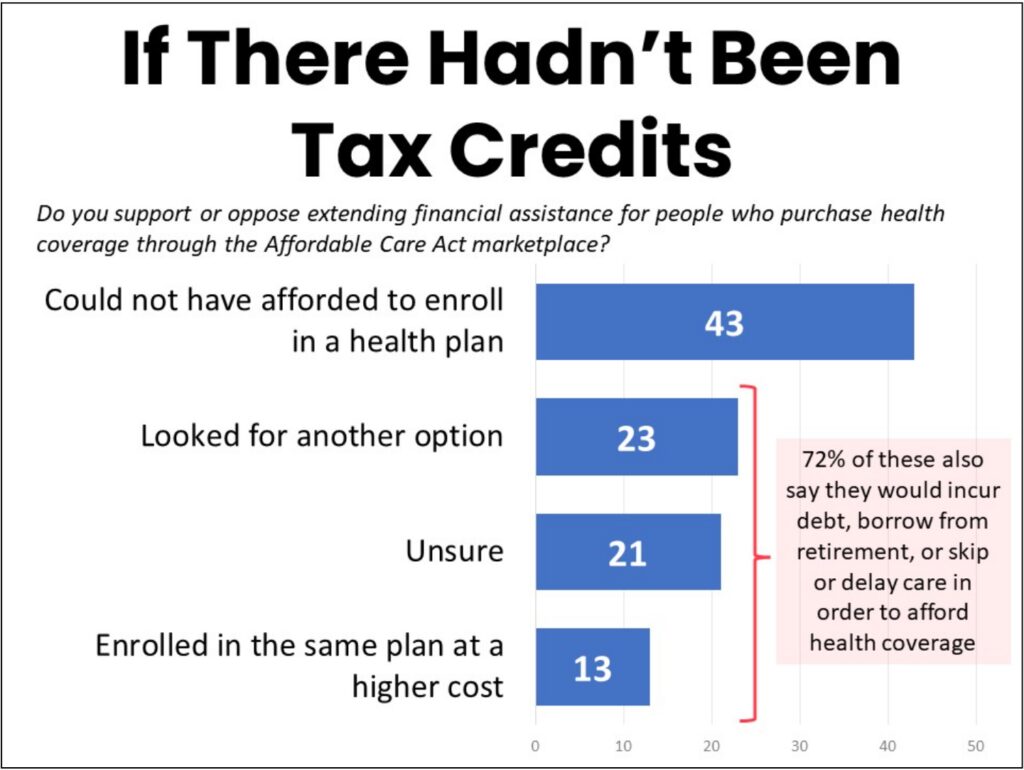

Cancer Patients and Survivors Will Suffer Without Enhanced Premium Tax Credits.

- 43 Percent of Cancer Patients And Survivors Surveyed Said They Could Not Afford Health Care Without The Enhanced Premium Tax Credits. 21 percent said they are not sure what they would do if the enhanced premium tax credits expired.

- Thirty Percent Said They Would Need To Skip Or Delay Health Care. One in four said they would accumulate debt in order to keep coverage. Nearly one in five stated they would borrow from hard earned retirement savings.

- Twelve Percent of Cancer Patients Said They Did Not Expect To Survive Their Cancer Treatment Without The Tax Credits. They said they would not be able to afford treatment without the enhanced premium tax credits.

The Department of Treasury Found That Over 2.7 Million Small Business Owners and Self-Employed Workers Count On The Tax Credits for Affordable Health Care.

- 28 Percent of Americans Ages 21-64 Who Rely on The Tax Credits Are Small Business Owners or Self-Employed. Before the Affordable Care Act, self-employed workers and small business owners had limited options to purchase affordable, high quality health coverage. The premium tax credits made it possible for people to start new businesses and maintain the security of affordable health coverage.

- 285,000 Small Business Owners and Self-Employed Americans Relied on Enhanced Premium Tax Credits To Afford Health Care in 2022. The American Rescue Plan Act of 2021 and the Inflation Reduction Act of 2022 increased the size of the credit for households with incomes below 400 percent of the poverty level and expanded eligibility to households with incomes above 400 percent of the poverty level for the first time. Over 2.7 million, or 82 percent, of self-employed workers and small business owners enrolled in Marketplace coverage in 2022 claimed premium tax credits – including about 285,000 small business owners and self-employed making greater than 400 percent of the federal poverty level or $54,360 a year who became newly eligible.

New Polling By Keep Americans Covered Finds 86 Percent of Voters Support Extending The Enhanced Premium Tax Credits.

- There Is Broad, Bipartisan Support For Extending The Enhanced Premium Tax Credits. 82 percent of Trump voters believe newly-elected leadership should take action to extend the tax credits.