Angry at the failure of his partisan effort to repeal health care and because of his hatred for former President Obama, Trump is threatening to cancel payments that help lower people’s deductibles and other out-of-pocket costs. Who will pay the price? Everyday people trying to afford health coverage. Trump’s efforts to sabotage health care have already caused costs to go up. Now, his latest scheme will mean people will have to pay 19% more for their coverage, and could mean that insurance companies are forced to leave some parts of the country altogether.

Republican Members of Congress have recognized that there needs to be swift bipartisan action. Independent experts, business leaders, insurers and insurance commissioners all agree that Trump’s threat is putting at risk people’s health coverage. And the American public — 74 percent — wants Trump and his Administration to do what they can to make the law work — not continue to do what they can to make it fail.

Will Trump listen to his own party, experts and voters? Or will he ignore the facts and punish the American people?

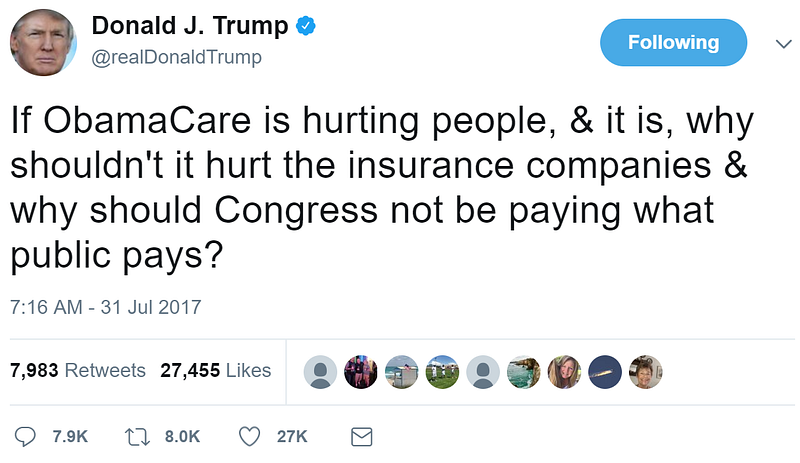

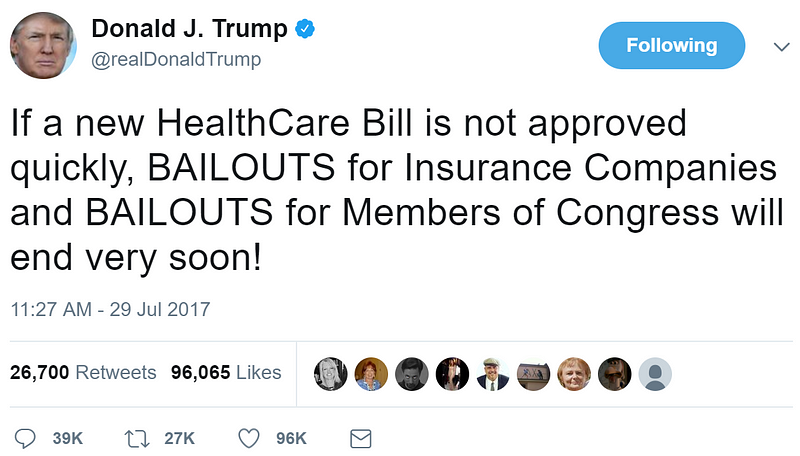

IN RECENT DAYS, TRUMP HAS UPPED HIS THREATS TO DESTABILIZE THE INDIVIDUAL MARKET IN RETALIATION FOR THE SENATE’S FAILED BID TO REPEAL HEALTH CARE

HOWEVER, TRUMP’S STANCE IS THE OPPOSITE OF A NUMBER OF REPUBLICAN SENATORS AND REPRESENTATIVES WHO ARE CALLING FOR BIPARTISAN ACTION TO STRENGTHEN THE INDIVIDUAL MARKET

Senate Majority Leader Mitch McConnell (R-KY): “Some Kind Of Action With Regard To The Private Health Insurance Market Must Occur. No Action Is Not An Alternative.” “‘If my side is unable to agree on an adequate replacement, then some kind of action with regard to the private health insurance market must occur,’ McConnell said. ‘No action is not an alternative. We’ve got the insurance markets imploding all over the country, including in this state.’” [Washington Post, 7/6/17]

Rep. Mark Meadows (R-NC): “I Don’t Think That Letting It Fail Is The Best Option, Even Though It Certainly Allows Additional Pressure To Happen.” “‘I don’t think that letting it fail is the best option, even though it certainly allows additional pressure to happen,’ said Rep. Mark Meadows, R-N.C., who is chairman of the House Freedom Caucus and close ties to the White House. ‘We can do better than that.’” [Washington Examiner, 7/31/17]

Rep. Mark Amodei (R-NV): Amodei Disagrees With President Trump, Believes The Individual Market Should Not Be Allowed To Fail. “Rep. Mark Amodei, R-Nev., rebuked Trump more directly. ‘No,’ he said when asked if he agreed with the president. ‘Clear-cut question — no.’” [Washington Examiner, 7/31/17]

Sen. John Thune (R-SD): “I Hope The President Will Continue To Make Those Payments.” [Kasie Hunt Tweet, 8/1/17]

Sen. Lisa Murkowski (R-AK): “The Senate Should Step Back And Engage In A Bipartisan Process To Address The Failures Of The ACA And Stabilize The Individual Markets.” “As I’ve been saying, the Senate should take a step back and engage in a bipartisan process to address the failures of the ACA and stabilize the individual markets. That will require members on both sides of the aisle to roll up their sleeves and take this to the open committee process where it belongs.” [Murkowski Statement, 7/18/17]

Sen. Lisa Murkowski (R-AK): “The Senate Should Take A Step Back And Engage In A Bipartisan Process To Address The Failures Of The ACA And Stabilize The Individual Markets.” “As I’ve been saying, the Senate should take a step back and engage in a bipartisan process to address the failures of the ACA and stabilize the individual markets. That will require members on both sides of the aisle to roll up their sleeves and take this to the open committee process where it belongs.” [Sen. Murkowski, 7/18/17]

Sen. Bill Cassidy (R-LA): “I Want To Stabilize The Insurance Market.” “Asked if a bipartisan stabilization bill would be needed if the current GOP bill fails, Sen. Bill Cassidy (R-La.) said, ‘I presume.’ He left the door open to supporting such a measure. ‘It depends on what it looks like, but I want to stabilize the insurance market,’ Cassidy said. ‘Families are paying too high premiums, so we’ve got to lower premiums.’” [The Hill, 7/13/17]

Sen. Bill Cassidy (R-LA): “Families Would Be Hurt” If Payments Not Made.” [Sahil Kapur Tweet, 8/1/17]

Sen. Ron Johnson (R-WI): The Senate Should “Bite The Bullet And Stabilize Those Markets.” “Sen. Ron Johnson (R-Wis.) has for months called for a bipartisan stabilization bill that would guarantee funding for ObamaCare payments, known as cost-sharing reductions, to insurers. Those payments are key to avoiding premium spikes and keeping insurers in the markets. Johnson said Tuesday that he hopes the GOP can pass something next week, but if not, ‘bite the bullet and stabilize those markets.’” [The Hill, 7/13/17]

Sen. John Hoeven (R-ND): “We Need To Stabilize The Health Insurance Market.” “Obamacare is failing and premiums continue to increase dramatically with some markets down to one or no insurance providers. That is why we need to make reforms to provide Americans with access to health care and affordable health insurance with more choice and competition. The CBO score of the Senate draft health care bill indicates that this legislation needs additional work to ensure that it meets this goal. Also, health care reform will be a process, not one bill. We need to stabilize the health insurance market to make it more competitive so consumers have access to better and more affordable health care policies. In addition, we want to ensure that low-income people have access to health care coverage either through Medicaid or a refundable tax credit that enables them to buy their own health insurance policy.” [Hoeven Statement, 6/27/17]

Sen. Lamar Alexander (R-TN): “The Senate Health Committee Has A Responsibility During The Next Few Weeks To Hold Hearings And Continue Exploring How To Stabilize The Individual Market.” “My main concern is doing all I can to help the 350,000 Tennesseans and 18 million Americans in the individual market who may literally have no options to purchase health insurance in 2018 and 2019. However the votes come out on the health care bill, the Senate health committee has a responsibility during the next few weeks to hold hearings to continue exploring how to stabilize the individual market. I will consult with Senate leadership and then I will set those hearings after the Senate votes on the health care bill.” [Alexander Statement, 7/18/17]

Sen. Lamar Alexander (R-TN): We Should “Approve The Temporary Continuation Of Cost-Sharing Subsidies For Deductibles And Co-Pays.” “‘While we build replacements, we want the 11 million Americans who now buy insurance on the exchanges to be able to continue to buy private insurance. Among the actions that will help are to… approve the temporary continuation of cost-sharing subsidies for deductibles and co-pays.’” [Politico Pro, 1/13/17]

INSURANCE COMPANIES AND STATE INSURANCE COMMISSIONERS HAVE WARNED THAT DEFAULTING ON COST SHARING PAYMENTS WILL INCREASE PREMIUMS, DESTABILIZE THE INDIVIDUAL MARKET, AND POTENTIALLY DISRUPT COVERAGE

National Association Of Insurance Commissioners: “Congress Must Act Quickly To Stabilize The Individual Health Insurance Marketplace Before They Adjourn For The District Work Period.” “As the latest attempt to repeal and replace the Affordable Care Act has failed, Congress must act quickly to stabilize the individual health insurance marketplace before they adjourn for the district work period. The window to act is rapidly closing, as rates must be finalized by mid-August and insurers are deciding whether to remain in this market or not. Without action, we anticipate more and more insurance companies pulling out across the country and significant premium rate increases in the majority of states. The National Association of Insurance Commissioners (NAIC) urges the Congress to take two immediate actions — fund CSR payments and market stability funding — to help shore up these markets. Cost-sharing reduction (CSR) payments are critical to the viability of the individual health insurance markets in a significant number of states and must be funded through 2018. Sufficient and sustained market stabilization funding for states to establish reinsurance programs or high-risk pool programs is also needed for long-term stability beyond 2018. These two actions alone would go a long way toward steadying the individual markets while ongoing debates over legislative replacement and reform options continue.” [NAIC, 7/28/17]

National Association of Insurance Commissioners: “We Write Today To Urge The Administration To Continue Full Funding For The Cost-Sharing Reduction Payments For 2017 And Make A Commitment That Such Payments Will Continue, Unless The Law Is Changed.” “On behalf of the nation’s state insurance commissioners, the primary regulators of U.S. insurance markets, we write today to urge the Administration to continue full funding for the cost-sharing reduction payments for 2017 and make a commitment that such payments will continue, unless the law is changed. Your action is critical to the viability and stability of the individual health insurance markets in a significant number of states across the country.” [Letter to Mick Mulvaney, 5/17/17]

Dan Hilferty, President and CEO, Independence Blue Cross: “We Firmly Believe Your Coverage Will Be There For 2018, If The Federal Government, Congress And President Commit To, Fund The Subsidies During An Interim Period Of Time.” “We firmly believe your coverage will be there for 2018, if the federal government, congress and president commit to, fund the subsidies during an interim period of time when we look at how we can fix the program long-term.” [CNN, 7/19/17]

Kurt Giesa, Practice Leader, Oliver Wyman Actuarial Consulting: “If payers do not gain clarity on funding of CSR payments soon, they will have to build that cost into their premiums.” “ … the current uncertainty regarding health reform and the ACA exchanges is making actuaries’ task as difficult as it has ever been … Two market influences, in particular, are complicating 2018 rate setting: the uncertainty surrounding continued funding of cost sharing reduction (CSR) payments and the question of how the relaxation of the individual mandate will impact enrollment and risk pools. Our modeling shows that this uncertainty, if it remains, could lead payers to submit rate increases between 28 and 40 percent, and more than two-thirds of those increases will be related to the uncertainty around CSR payments and individual mandate … If payers do not gain clarity on funding of CSR payments soon, they will have to build that cost into their premiums.” [Oliver Wyman Analysis, 6/14/17]

Dr. Mario Molina, Former CEO Of Molina Healthcare: ‘Don’t Let The Administration Fool You’ Into Thinking Insurers Are To Blame For Raising Premiums Instead Of Sabotage.” “The administration and Republicans in Congress want you to believe that insurers raising premiums for their plans or exiting the marketplaces all together are consequences of the design of the Affordable Care Act instead of the direct results of their own actions to sabotage the law. Don’t let them fool you.” [Op-Ed in US News & World Report, 5/30/17]

Dave Jones, California State Insurance Commissioner: “President Trump Appears On A Mission To Destroy Health-insurance Markets By Creating Instability Through His Own Actions And Thereby Depriving Millions Of Americans Of Health-care Coverage.” “President Trump’s first executive order directed federal agencies to ‘waive, defer, grant exemptions from, or delay’ ACA requirements. The IRS then announced reduced enforcement of the ACA health-insurance mandate, which in turn exposes health insurers to tremendous uncertainty as to who will be in the 2018 market. President Trump also threatens to cut the ACA assistance that consumers rely on to afford health care. In April Mr. Trump stated, ‘ObamaCare is dead next month if it doesn’t get that money.’ Just last month the nation’s insurance commissioners wrote to the Trump administration requesting assurances that cost-sharing reduction payments will continue, noting that this is critical to the ‘viability and stability of the individual marketplace.’ No such assurance has been provided. President Trump appears on a mission to destroy health-insurance markets by creating instability through his own actions and thereby depriving millions of Americans of health-care coverage.” [Letter to the Editor in Wall Street Journal, 6/27/17]

Marguerite Salazar, Colorado’s State Insurance Commissioner: The Trump Administration Threatens The Whole Market. “In Colorado, where most consumers continue to have multiple insurance choices, commissioner Marguerite Salazar said the Trump administration threatens the whole market. ‘My fear is it may collapse,’ she said.” [Los Angeles Times, 5/18/17]

John Naylor, CEO Of Medica In Iowa: “It Is Challenging To Stay Focused On Our Mission To Provide Access To High-quality Affordable Health Care When There’s Noise Around The System And A Lack Of Clarity Of Rules.” “‘It is challenging to stay focused on our mission to provide access to high-quality affordable health care when there’s noise around the system and a lack of clarity of rules,’ said John Naylor, chief executive of Medica, who called the amount of uncertainty being thrown at insurers at the moment unprecedented.” [Washington Post, 5/12/17]

Eric A. Cioppa, Superintendent of the Maine Bureau of Insurance: “If They Don’t Get A Subsidy, I Fully Expect Double-digit Increases For Three Carriers On The Exchanges Here.” “The uncertainty is extremely problematic. If they don’t get a subsidy, I fully expect double-digit increases for three carriers on the exchanges here.” [New York Times, 6/4/17]

Danielle Devine, Michigan Director of Operations, Meridian Health Plan: “The Uncertainty Over The Future Of The Subsidies Creates The Largest Reason For Significant Rate Increases.” “The political climate continues to make it difficult to price and the uncertainty over the future of the subsidies creates the largest reason for significant rate increases.” [Crain’s Detroit Business, 6/14/17]

Rick Notter, Director of Individual Business, Blue Cross Blue Shield of Michigan: “If We Don’t Have That Cost-sharing (Subsidy), We Have To Make Up The Difference And The Only Way For Us To Do That Is With A Higher Rate.” “If we don’t have that cost-sharing (subsidy), we have to make up the difference and the only way for us to do that is with a higher rate.” [Detroit Free Press, 6/14/17]

John Goodnow, CEO, Benefis Health System in Montana: Goodnow Said The Lifespan Of The Affordable Care Act Has Been Shortened Because Insurance Companies Are Pulling Out Of The Exchanges ‘because Of All The Fear That’s Been Created Over Funding.’ “Republicans are injecting instability into federal insurance marketplaces by suggesting lowering subsidies for people who buy coverage, and it’s a ‘slick trick’ to ensure the failure of the exchanges, the head of one of Montana’s largest hospitals said Thursday … Great Falls-based Benefis CEO John Goodnow said the lifespan of the Affordable Care Act has been shortened because insurance companies are pulling out of the exchanges ‘because of all the fear that’s been created over funding. ‘All you have to do is threaten to defund the subsidies,’ he said Thursday on a panel in Helena organized by the Montana Nurses Association to discuss the bill.” [Billings Gazette, 7/7/17]

Brad Wilson, CEO, Blue Cross Blue Shield of North Carolina: “The Failure Of The Administration And The House To Bring Certainty And Clarity By Funding CSRs Has Caused Our Company To File A 22.9 Percent Premium Increase, Rather Than One That Is Materially Lower.” “The failure of the administration and the House to bring certainty and clarity by funding CSRs has caused our company to file a 22.9 percent premium increase, rather than one that is materially lower. That will impact hundreds of thousands of North Carolinians.” [Washington Post, 5/26/17]

Teresa Miller, Pennsylvania Insurance Commissioner: “Instability Caused By Adverse Action From The Federal Government Will Do Nothing But Hurt Consumers Who Are Stuck In The Middle.” “Information provided by insurers shows the extent to which instability and changes would impact Pennsylvania’s 2018 health insurance rates. This proves what we already know — instability caused by adverse action from the federal government will do nothing but hurt consumers who are stuck in the middle. The 506,000 Pennsylvanians with Affordable Care Act-compliant plans in the individual market deserve single-digit rate increases like the ones most people will see if Congress and the Trump Administration choose not to risk consumers’ health and financial well-being by jeopardizing the stability of these markets.” [Press Release, 6/1/17]

Julie Mix McPeak, Tennessee State Insurance Commissioner: “Members Could Help Bring Immediate Stability And Potential Rate Relief For Our Consumers By Appropriating Cost-sharing Reduction Payments For The 2017 And 2018 Plan Years.” “As Congress continues to debate ACA reform efforts, Members could help bring immediate stability and potential rate relief for our consumers by appropriating cost-sharing reduction payments for the 2017 and 2018 plan years. Every dollar matters when Tennessee consumers are feeling like they need to choose between health insurance or groceries or mortgage payments and the Congress could take action that would pay immediate dividends.” [Statement, 7/7/17]

Julie Mix McPeak, Tennessee State Insurance Commissioner: “No One Feels Optimistic About The Market If CSRs Are Not Funded.” “I asked my colleagues at a meeting of insurance commissioners nationwide, and no one feels optimistic about the market if CSRs are not funded. We would prefer for funding of those cost-sharing reductions through ’19. Again figuring out who gets to make that decision has been tough for us as regulators …It’s that instability, that uncertainty, the insurers hate the most. They are going to price for that.” [The Tennessean, 5/12/17]

Kelly Paulk, Vice President, Product Strategy and Individual Markets, BlueCross BlueShield of Tennessee: Factoring In Whether The Cost-Sharing Reductions Are Paid And If The Coverage Mandate Will Be Enforced Will Raise Premiums By 21 Percent On Average. “Our 2017 rates are allowing us to earn a margin (profit) for the first time in four years and would have enabled us to propose only a small increase for 2018 to cover expected changes in medical and operating costs. However, we have to factor in two significant uncertainties — whether the federal government will fund cost-sharing reductions for low-income members and how the risk pool will change if the coverage mandate is not enforced … Combining those two factors leads to an average 21 percent rate increase.” [Blog Post, 6/30/17]

Mike Kreidler, Washington State Insurance Commissioner: “The Current Federal Administration’s Actions — Such As Not Committing To Reimburse Insurers For Cost-sharing Subsidies And Not Enforcing The Individual Mandate — Appear Focused Only On Destabilizing The Insurance Market.” “There is a great deal of uncertainty underlying our country’s health insurance system today and no state is immune. There are specific issues with our health insurance system that we need to address, such as the rising costs of prescription drugs and health care services. Yet, the current federal administration’s actions — such as not committing to reimburse insurers for cost-sharing subsidies and not enforcing the individual mandate — appear focused only on destabilizing the insurance market. Sadly, it’s the people in our communities and across the country who will pay the price.” [Statement, 6/19/17]